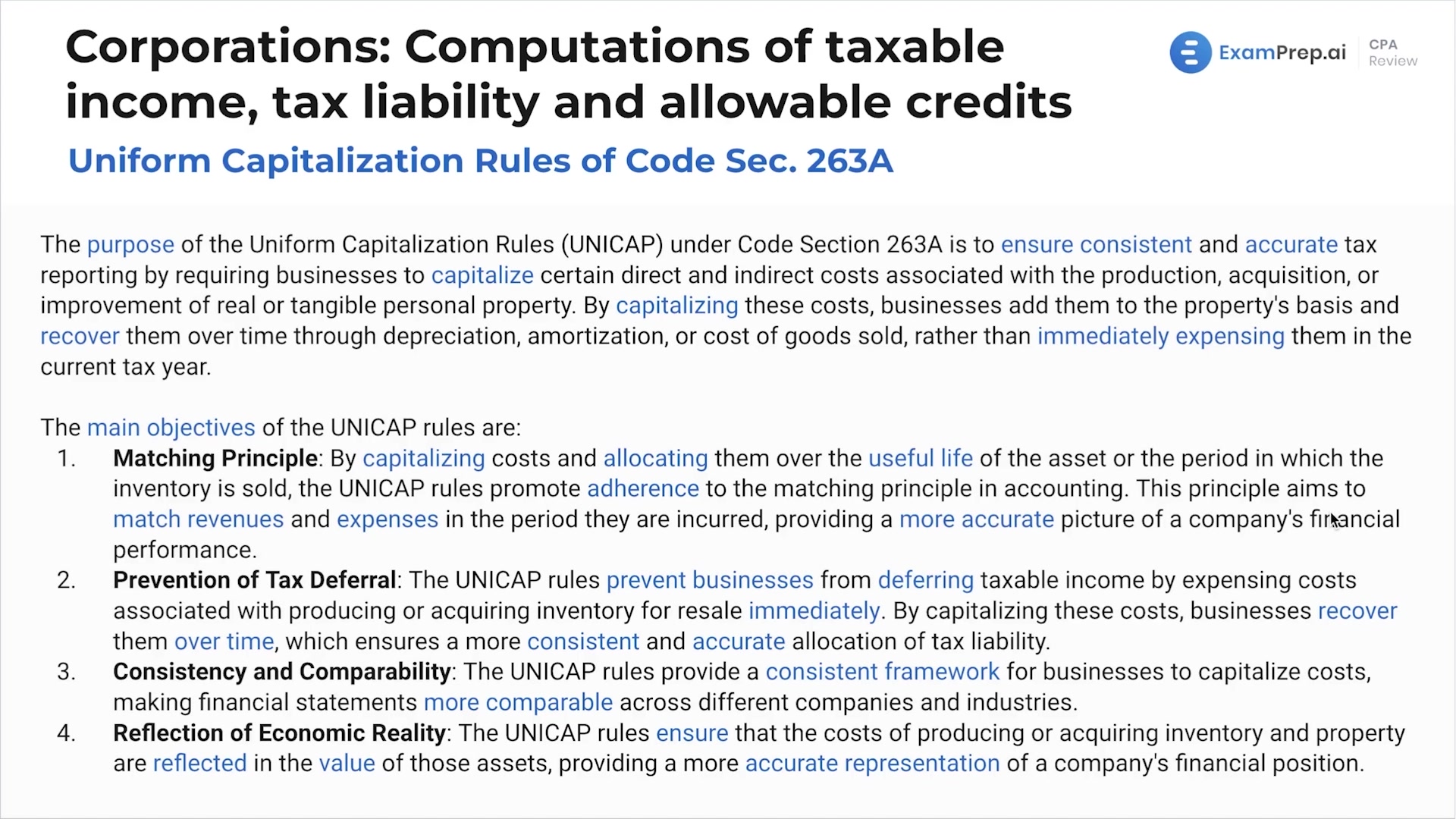

In this lesson, Nick Palazzolo takes on the ins and outs of Uniform Capitalization Rules as outlined in Code Section 263A, guiding through the requirements for capitalizing costs directly or indirectly associated with the production of real or tangible personal property. By diving into the implications for companies subject to the UNICAP rules, Nick clearly distinguishes between expensing and capitalizing costs, and how this affects a company's taxable income, cash flow, and record-keeping. Breaking down complex topics such as direct labor, direct materials, indirect costs, and exceptions to the rules, this lesson is a treasure trove for understanding the impact of UNICAP on financial statements and tax liabilities. Additionally, Nick reflects on the economic rationale behind these rules and their alignment with the matching principle in accounting, making this a comprehensive resource on navigating the nuanced world of tax accounting and its implications on business financials.

This video and the rest on this topic are available with any paid plan.

See Pricing