Corporations: Computations of Taxable Income, Tax Liability and Allowable Credits

Corporations are required to calculate their taxable income by adjusting their financial accounting income with specific tax provisions, which involves adding back non-deductible expenses, and subtracting any income that is exempt from tax. The tax liability is then determined by applying the appropriate corporate tax rates to this taxable income. Additionally, corporations may reduce their tax liability by taking advantage of various tax credits for which they are eligible, such as those for research and development or investments in certain assets.

Lesson Videos

Corporations: Computations of Taxable Income, Tax Liability and Allowable Credits Overview

Corporations: Computations of Taxable Income, Tax Liability and Allowable Credits Overview

Introduction to Corporations: Computations of Taxable Income, Tax Liability, and Allowable Credits

Introduction to Corporations: Computations of Taxable Income, Tax Liability, and Allowable Credits

Corporate Taxable Income

Corporate Taxable Income

Rental Lease Income

Rental Lease Income

Income Generated from an Illegal Activity

Income Generated from an Illegal Activity

Related Party Accrual to Cash Exception

Related Party Accrual to Cash Exception

Charitable Contributions and Dividends-Received Deduction

Charitable Contributions and Dividends-Received Deduction

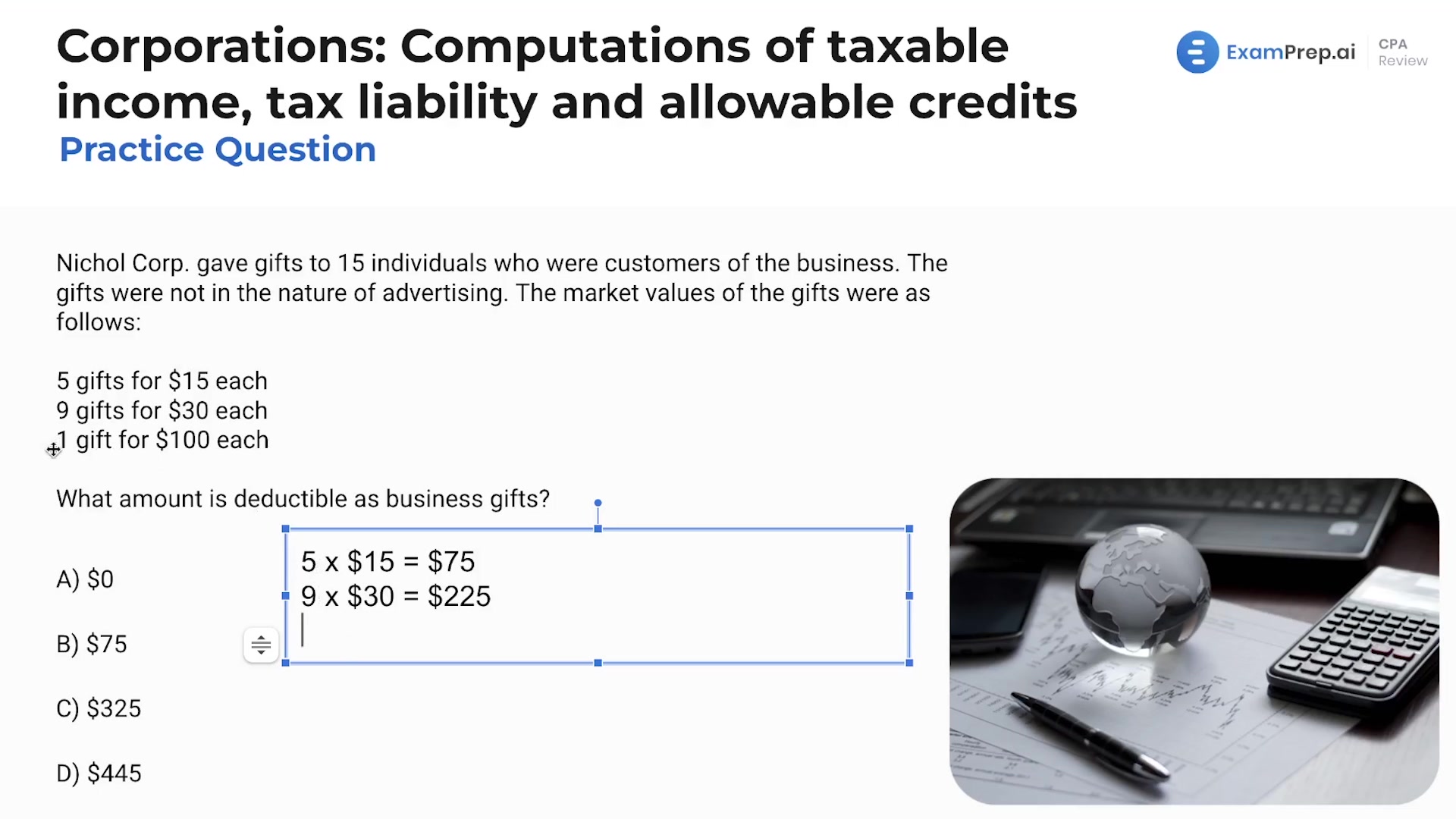

Business Gifts

Business Gifts

Corporate Capital Losses

Corporate Capital Losses

Business Interest

Business Interest

Credits Applicable to Corporate Taxation

Credits Applicable to Corporate Taxation

Accumulated Earnings Tax

Accumulated Earnings Tax

Personal Holding Company Tax

Personal Holding Company Tax

Uniform Capitalization Rules

Uniform Capitalization Rules

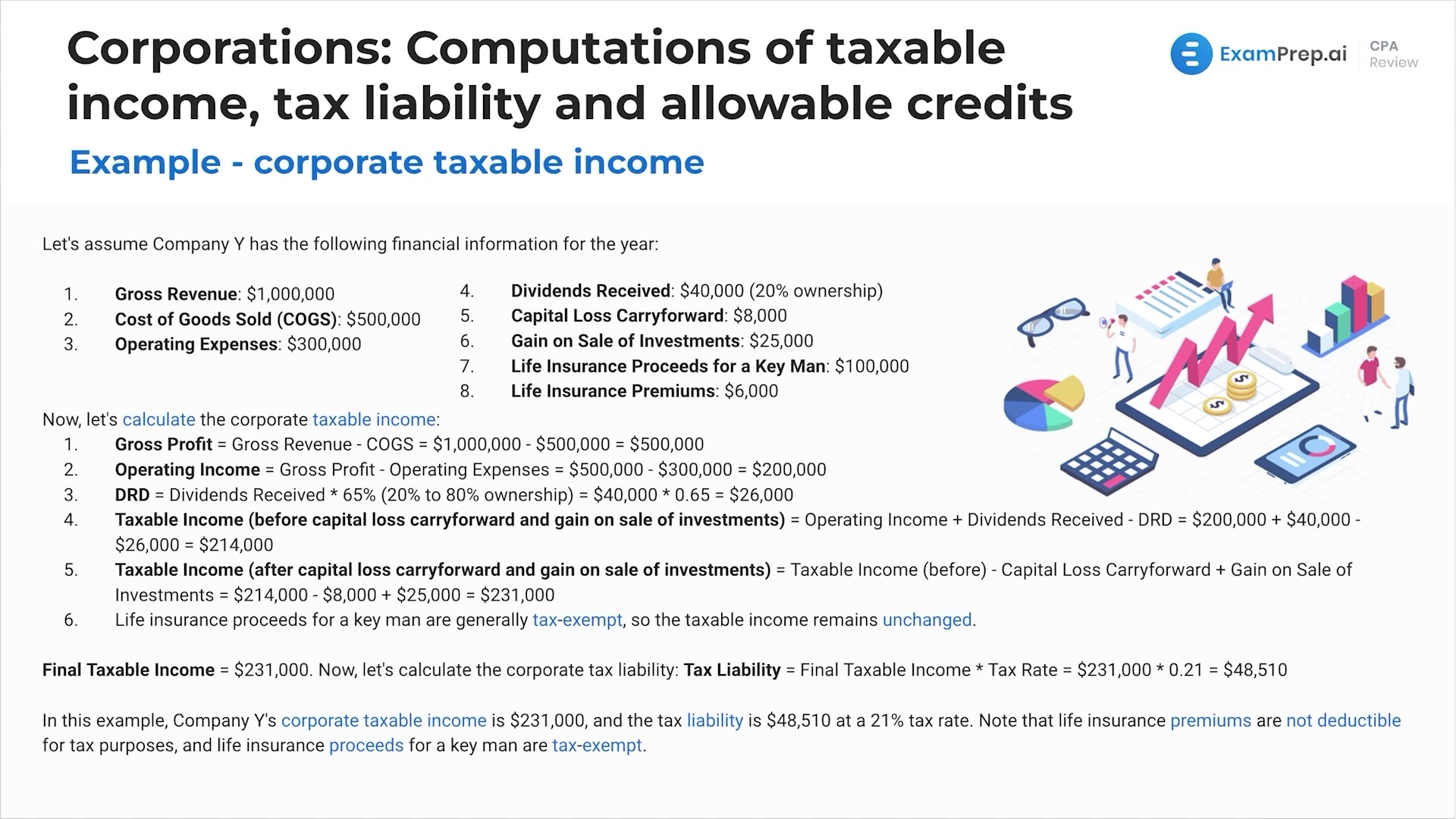

Example of Corporate Taxable Income

Example of Corporate Taxable Income

Corporations: Computations of Taxable Income, Tax Liability and Allowable Credits Summary

Corporations: Computations of Taxable Income, Tax Liability and Allowable Credits Summary

Corporations: Computations of Taxable Income, Tax Liability and Allowable Credits - Practice Questions

Corporations: Computations of Taxable Income, Tax Liability and Allowable Credits - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate