Corporations: Differences Between Book and Tax Income

Corporations often report different amounts of income for financial accounting purposes (book income) and for tax reporting (tax income) due to variances in accounting methods, timing of income recognition, and allowable deductions. These differences stem from the distinct objectives of financial reporting, which focuses on providing information to investors and creditors, and tax accounting, which is governed by tax laws aimed at calculating taxable income.

Lesson Videos

Corporations: Differences Between Book and Tax Income Overview

Corporations: Differences Between Book and Tax Income Overview

Introduction to Differences Between Book and Tax Income

Introduction to Differences Between Book and Tax Income

Temporary Differences Between Book and Tax Income

Temporary Differences Between Book and Tax Income

Permanent Differences Between Book and Tax Income

Permanent Differences Between Book and Tax Income

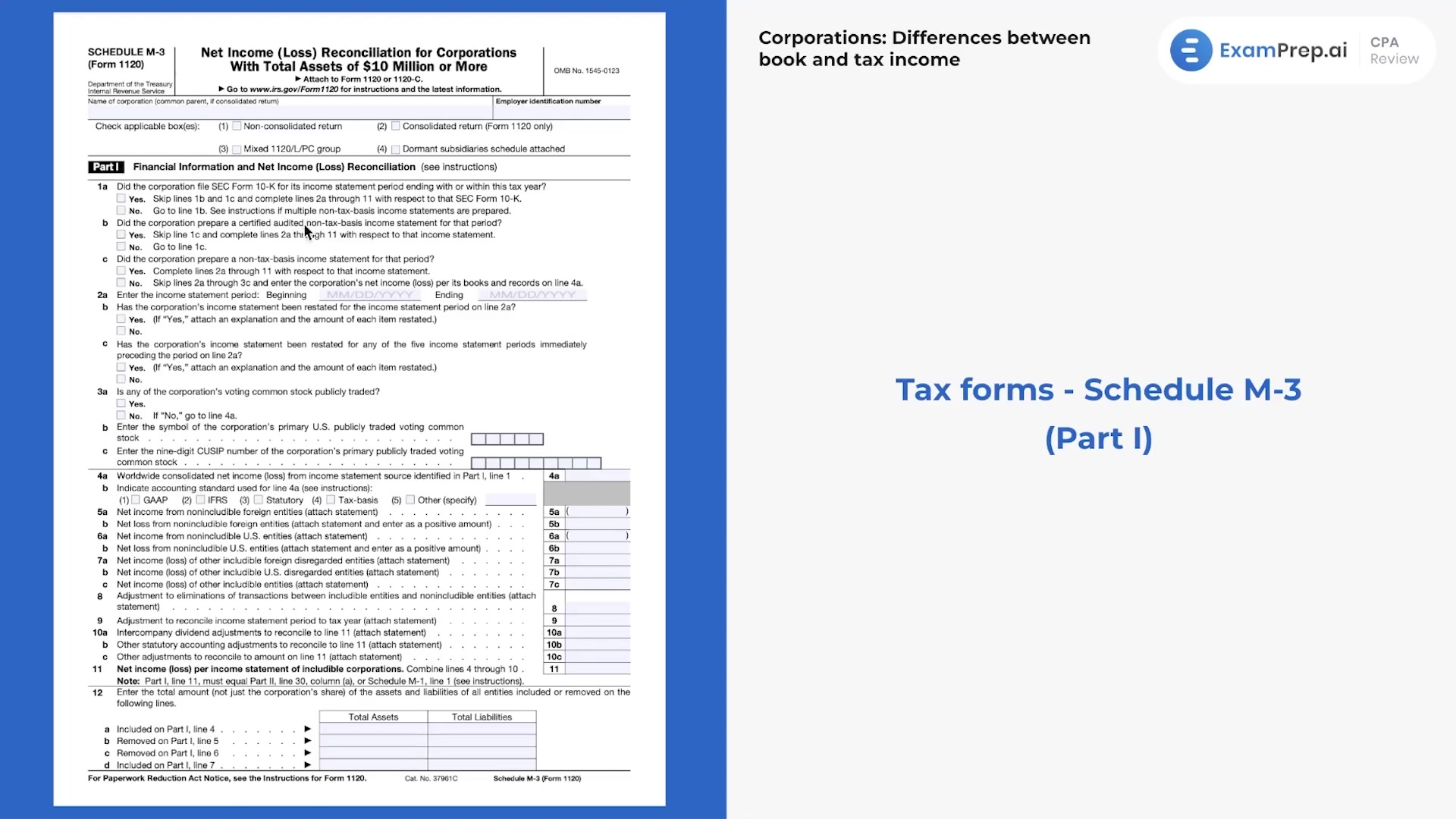

Schedules Used for Reconciliation

Schedules Used for Reconciliation

Gross Income

Gross Income

Items Excluded from Tax Income

Items Excluded from Tax Income

Ordinary Expenses

Ordinary Expenses

Book Items Not Deductible for Tax Purposes

Book Items Not Deductible for Tax Purposes

Basics of Deferred Taxes

Basics of Deferred Taxes

Corporations: Differences Between Book and Tax Income Summary

Corporations: Differences Between Book and Tax Income Summary

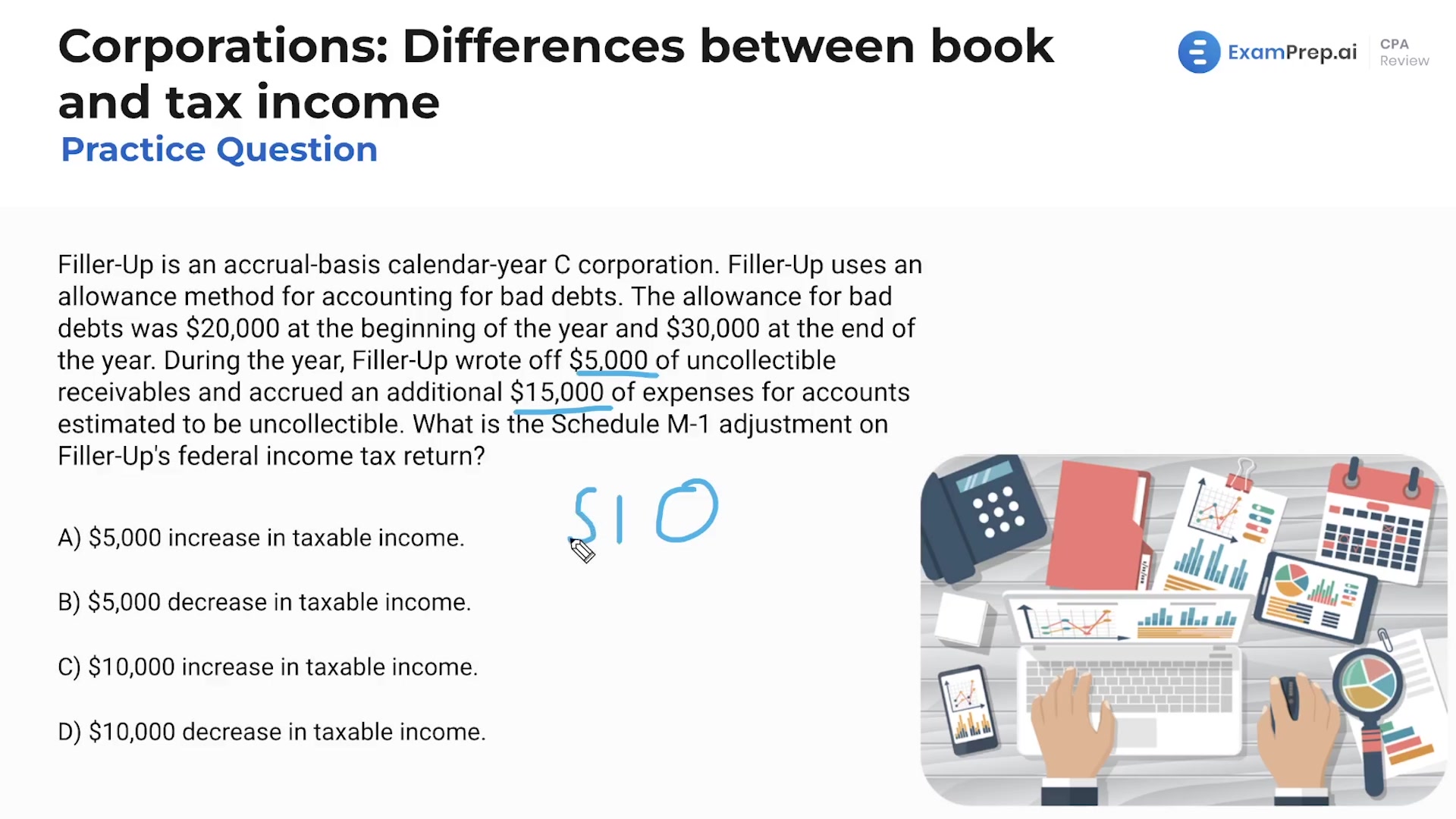

Corporations: Differences Between Book and Tax Income - Practice Questions

Corporations: Differences Between Book and Tax Income - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate