Corporations: Tax Treatment of Formation and Liquidation of Business Entities

Corporations: Tax Treatment of Formation and Liquidation of Business Entities refers to the specific Internal Revenue Code provisions and regulations applicable to the fiscal implications when a corporation is created, structures its capital, and distributes its assets in the event of dissolution. This includes the analysis of tax-free contributions, basis calculations of property and stock received, as well as the recognition of gains or losses upon liquidation.

Lesson Videos

Corporations: Tax Treatment of Formation and Liquidation of Business Entities Overview

Corporations: Tax Treatment of Formation and Liquidation of Business Entities Overview

Introduction to Tax Treatment of Corporations

Introduction to Tax Treatment of Corporations

Issuance, Reacquisition, and Resale of Stock

Issuance, Reacquisition, and Resale of Stock

Corporate Taxation

Corporate Taxation

Property Acquired by Corporations

Property Acquired by Corporations

Tax Implications of Forming a C Corporation

Tax Implications of Forming a C Corporation

Additional Corporate Taxes

Additional Corporate Taxes

Corporate Distributions: Tax Treatment

Corporate Distributions: Tax Treatment

Stock Redemption

Stock Redemption

Corporations: Tax Treatment of Formation and Liquidation of Business Entities Summary

Corporations: Tax Treatment of Formation and Liquidation of Business Entities Summary

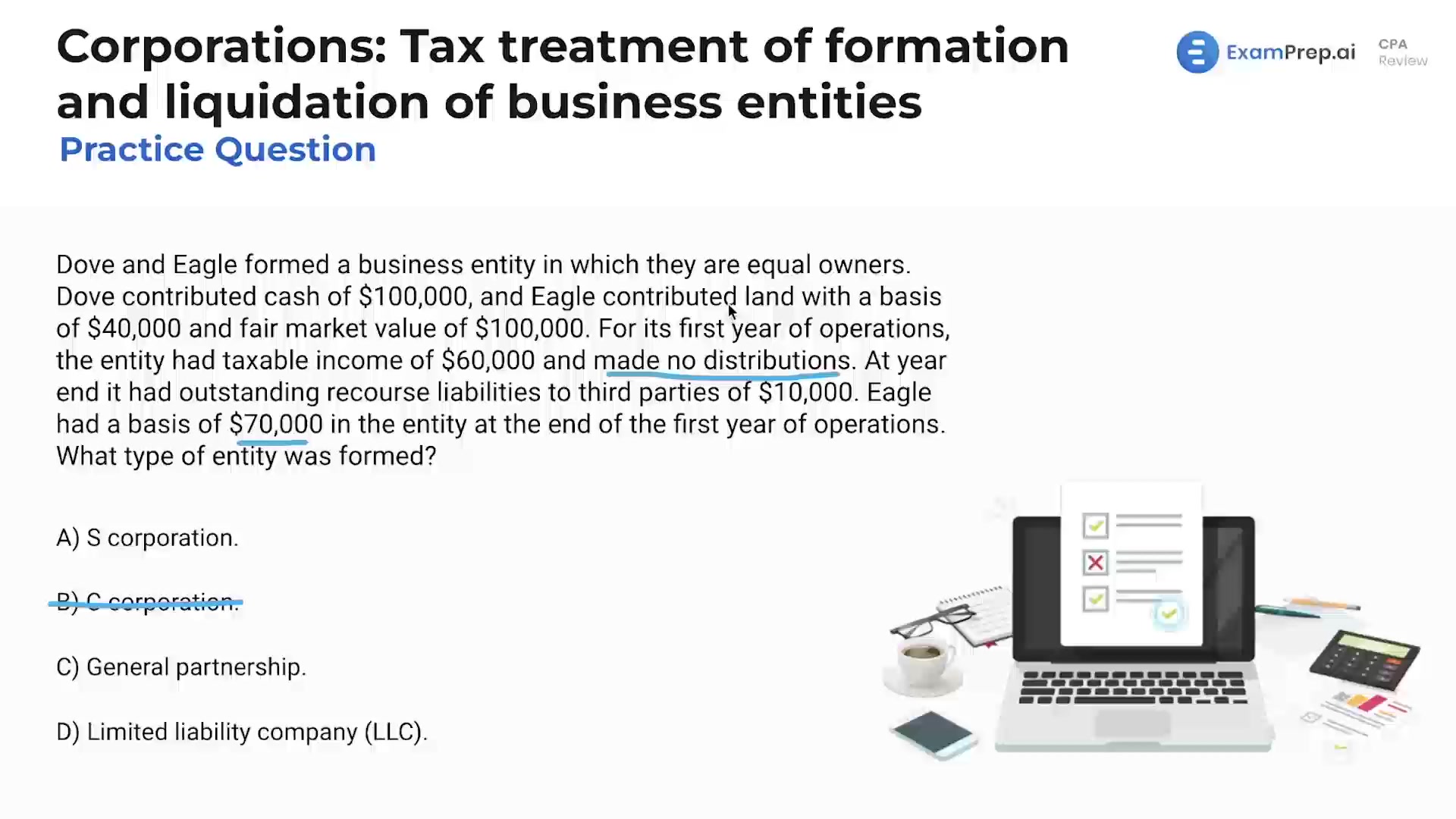

Corporations: Tax Treatment of Formation and Liquidation of Business Entities - Practice Questions

Corporations: Tax Treatment of Formation and Liquidation of Business Entities - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate